What Do You Mean My Credit Score Affects My Car Insurance Rates?

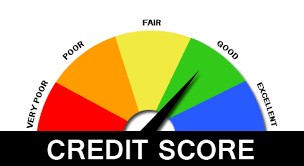

Did you know that most states allow car insurance companies to calculate credit-based auto/home insurance scores when determining your risk assessment and premium for your car insurance policy? That means that your credit score could affect your car insurance rates. Learn more about how your credit score affects your car insurance rates and ways to improve your insurance score.

Why Your Credit Score Affects Your Car Insurance Rate

Have you heard words like tiering or scoring. They say it’s because they’ve correlated low credit scores with risky driving behaviors and poor driving records and vice versa. This means that if your credit-based auto insurance score is too low, you’re being deemed as one with a higher chance of filing a claim. Auto insurance scoring takes into account a snapshot of the information found in your credit score, plus your past auto insurance history. It's then added to your driving record and other pertinent information to calculate your personal rate. We can agree or disagree with it but it’s still out there being used and does affect your rate for many insurance carriers.

Your insurance score looks at your credit but typically doesn’t include as many factors as a credit score. It’s why reputable agents may ask for your social security number when giving you a quote. They aren’t snooping around your credit or just being nosy. It allows them to find more accurate, and possibly better, rates with their Insurers. Some companies don’t use the insurance scores but they’re not necessarily better rates for lower credit folks. So many things factor into a rate and this is only one aspect. Unless you’re with Solo Insurance®, ask your Agent/Broker for their best rate.

How Solo Insurance® Can Help You Get the Best Rate

We built our business on the promise of always giving our customers the best rate, no matter your circumstances, regardless of your credit and driving history. We will shop the rates for you and will always give you the best rate we can find. It’s been that way since 1994.

Ways to Improve Your Insurance Score

Here's some ways you can improve your insurance score.

- Improve your credit score

- Pay down debt

- Pay on time

- Keep your car/home/renters insurance policies active

- Don't start and stop insurance by not completing policy terms (going the whole 6 months or a year)

Get rewarded for your steadfastness with better rates.

For a free car insurance quote, contact Solo Insurance® online, request a quote, or call 1-800-207-7656.

Solo Insurance® where great rates and service meet. We shop the rates for you upfront and at renewals, always making sure you are with our best rate for your insurance needs. Like us on Facebook, follow us on Instagram and Twitter @thesoloins.

Solo Insurance® 800-207-7656 Get a Quote: https://www.soloinsurance.net/

– Veteran/Family owned since 1994 –